Risk appetite on a page

Turn a theoretical concept into a value adding exercise

The concept of risk appetite is complicated, technical and epitomises risk jargon that puts off stakeholders. Yet the fact it is written into the UK Corporate Governance Code as a Board responsibility indicates the importance, even to organisations not bound by the code. Many businesses have now articulated risk appetite but few are seeing the benefits from these efforts.

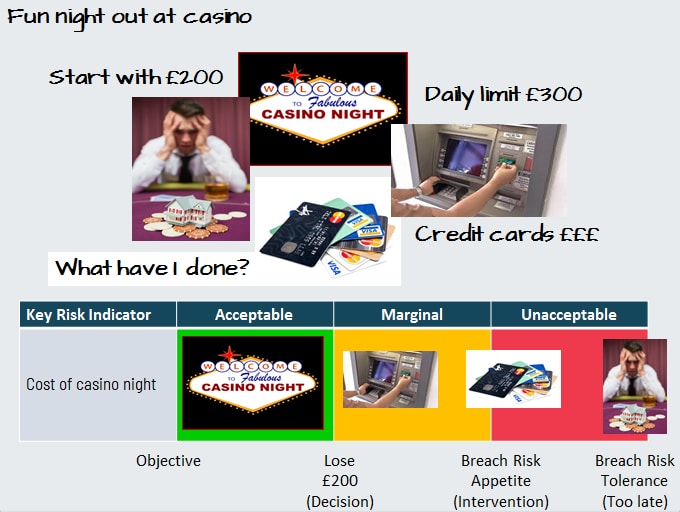

Why do we need risk appetite – casino night example

Imagine starting the night out with £200, it doesn’t start well and you’re quickly down to zero. Instead of calling it a night, you use the ATM and take the daily limit of £300. Very quickly, that is gone, upset but sure you can win it back, you take your credit cards out, one after the other, you max out on your credit limit until you eventually lose more than you can afford risking repossession of the house. How did a fun night out turn into such a nightmare? A simple example, but might management caught up in the desire or pressure to win at all cost, start taking excessive risks and fall down a slippery slope. Risk appetite with clear intervention and escalation points would ensure this never happens.

Implementing risk appetite to deliver value

Risk appetite is not a singular statement, instead it should be defined around key risk types, these could be in line with principal risks or broad categories, we recommend working with risk owners to draft risk appetite before a board discussion.

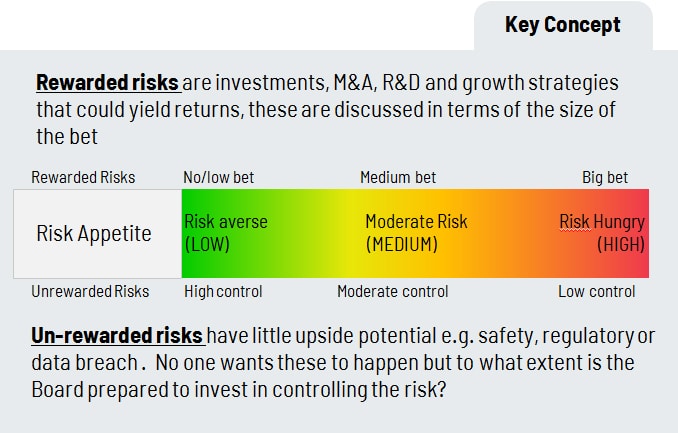

Risk appetite is usually defined in terms of risk averse or risk hungry, or a High/Med/Low scale but a key concept is to distinguish whether the risk is a rewarded or an unrewarded risk because these are described differently.

Draft a paragraph or two setting the Board’s attitude towards managing risk in this area, and minimum expectations that should be in place. Try to be as specific as possible including referring to key metrics.

Businesses often speak about KPIs and targets but few talk openly about minimum expectations.

Finally, discuss the results with the Board. Don’t be surprised if there are differences of opinion and gaps emerging between the current position and the Board’s expectations. These become priority actions and early wins from the exercise. Going forward, risk appetite becomes the limits and thresholds that define when interventions and escalations should be brought to the Board.

Scale risk with confidence